Valuation of software companies

If you Google «how to value my B2B SaaS company», you can get the impression that everything related to your business is important. However, the valuation of software companies and how much a business is worth is often data-driven and based on specific KPIs.

In this article, we want to share with you the methodology behind how to determine the value of a company and focus on the KPIs which will secure a high valuation.

Written By: Martin Senning Eriksen, Senior Investment Manager at Viking Venture

How to value a software company?

Market sentiment affects the value of both public and private companies. To calculate relevant software valuations, we need to include this in our valuation models. Bessemer Venture Partners (BVP), one of the world’s most prominent software investors, have created the BVP Cloud Index, which includes some of the largest public cloud companies. Viking Venture uses the median EV/R (Enterprise Value to Revenue) multiple for this index as the starting point for all valuations.

Challenging market

It is no secret that the market and SaaS valuation multiples for public SaaS companies has seen a correction in the last two years. If we take a closer look at the BVP Cloud Index, we see a decrease of 51 % in this period. Last week, the median EV/R multiple for the index was 6.0x compared to 11.4x two years ago.

We will not spend time discussing the reason for the fall in public markets, but we must realize that the levels we are seeing today are no lower than those pre-covid.

Scorecard for valuation of software companies

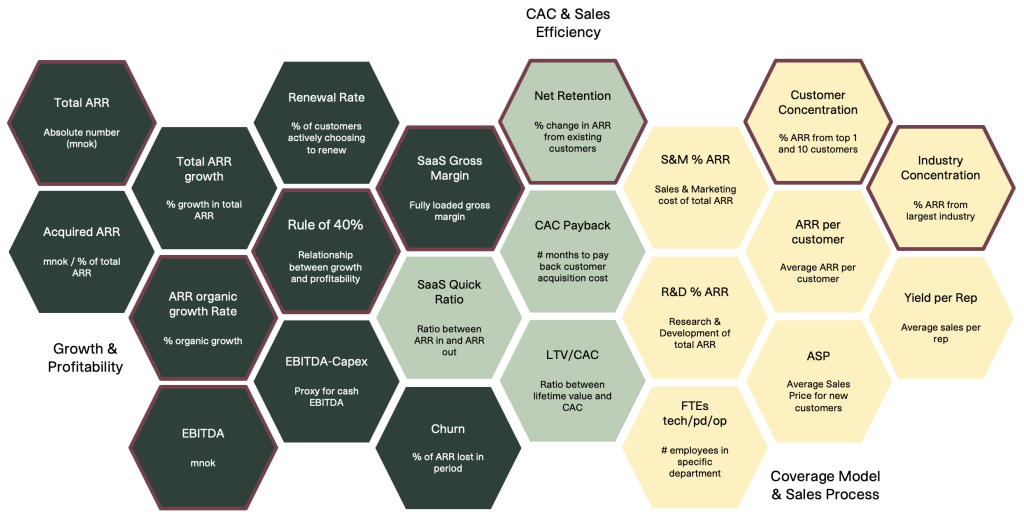

Although market sentiment undoubtedly plays a significant role in valuing a company, market development is outside of our control. However, we can control the development of our companies and their KPIs. Viking Venture has developed the Viking Venture Valuation Scorecard to value B2B SaaS companies.

Using the BVP Cloud Index as a starting point, we compare 8 SaaS KPIs to pre-defined benchmarks. If the target company performs above the benchmark for a given KPI, they are awarded an increase to their multiple. Conversely, if they perform below the benchmark for a given KPI, they are given a discount to their multiple. The sum of all increases and discounts, together with the BVP Cloud Index starting point, results in an EV/ARR multiple.

To capture all facets of a B2B SaaS company and at the same time keep the valuation model as simple as possible, we have chosen KPIs which measure the following:

1. Growth and profitability

2. Sales efficiency

3. Coverage model and sales process

In the next section, we will review the different areas and detail the KPIs in our model.

Valuation Scorecard uses a selection of the most important KPIs when valuing companies

Growth and profitability

Growth, growth, growth; this has always been the most critical KPI for SaaS valuation, which has not changed. However, not all growth is created equal. Organic growth in Annual Recurring Revenue (ARR) is the most valuable and the cornerstone of our valuation model. The most important factor is growing your company through a well-balanced mix of how your business operates within new sales, upsells, expansion, and price increases.

However, growth is not the be-all and end-all – especially in today’s market. Your company’s profitability is also essential, and we must ensure a healthy balance between growth and profitability. This balance is measured by looking at the Rule of 40. If the sum of our organic growth in ARR and EBITDA margin is greater than 40%, we are on track.

Your company’s gross margin is also important, but we need to break it down a little more for SaaS companies. The SaaS Gross Margin of your business is vital to determine how much money you can make on your products when we include all direct costs.

Customer Acquisition Cost and Sales Efficiency

When we are operating in an uncertain market, it is important that we can grow efficiently with our existing customers. Net Revenue Retention measures the development of our existing customer base. Said simpler, if we did not get a single new customer, what would our ARR be at the end of the year? You ought to know if the ARR would decrease or increase?

Coverage model and sales process

Lastly, it is essential to consider our coverage model and sales process. Are we operating in a software category in a growth phase? How many customers does our company have? You also need to consider if your company is industry-focused or industry agnostic?

All these areas affect our business’s value because they tell us something about our business’s inherent risk. Moreover, whether or not the market we operate in will help us grow organically or if we need to combine organic growth with inorganic growth.

Who can value a software company?

Anyone can value a company, and more often than not, there is quite a bit of variation in business valuations depending on who is calculating them and valuation methods. Investors, advisors, and founders will all be interested in valuing companies and may utilize many different methodologies. However, we can create a consistent model for software valuations by utilizing this data-driven, KPI-focused approach.

How to increase your value

If you want to maximize your company’s value to potential buyers, you need to ensure you are growing as much as possible while making sure you are capital efficient. Broken down, this means you need to increase your ARR organic growth rate simultaneously as you ensure your EBITDA or Free Cash Flow is at a healthy level.

The single best KPI for measuring this is the Rule of 40. As long as we are hitting 40% or above, we know that we are growing efficiently, which will result in higher valuations for your company.

KPIs to improve valuation of software companies

Want to learn more about essential KPIs for B2B SaaS companies? Our niche investment focus in solely B2B software-as-a-service (SaaS) companies allows us to track important SaaS KPIs and access highly relevant benchmarks across our portfolio. Take a closer look at the top SaaS KPIs that every Nordic software company should track and how they can help you make informed decisions about your company’s growth and profitability. In addition, how they affect SaaS company valuation.

Get more insights on how to scale your business

Sign up for our newsletter to get valuable insights and the latest perspectives on how Nordic software companies can scale faster. Learn how to improve sales processes, develop your management team, optimize pricing and accelerate through acquisitions.