How to price your SaaS products

How you price your SaaS product can have a tremendous impact on your annual recurring revenue (ARR) and profitability. However, it can be a difficult task to find the right price model for your software as a service (SaaS) business. This blog post will cover why you should consider changing the price model for your product, how you choose a suitable price model and the potential benefits of changing your price.

Why change the price of your SaaS products?

When Viking Venture invest in new SaaS companies, we often start our collaboration with a pricing project. One of the main reasons for this is that we generally observe that customers pay little compared to the value they get from SaaS products. Furthermore, the right price model and price points could significantly affect your ARR from new sales and your ARR from existing customers.

Make it easier to become a customer

Firstly, for new sales, the wrong price model could result in a high hurdle for potential customers to start using your product, whereas the correct saas pricing model could make it much easier for customers to take the step in becoming customers.

Increase profitability and scale faster

Secondly, choosing the right saas pricing could significantly increase the ARR from your existing customers. Imagine that your company has 10 million EUR in ARR and a 10 percent profit margin. If you raise your prices by 20 percent, you will have an ARR of 12 million EUR and a profit of 3 million EUR.

Price changes come at no cost, so the company in this example triples its profitability. This increased profitability could for instance be used to improve the product or to scale the sales organization, which again could help the company scale even faster.

Which pricing strategy to use?

There are many ways to price SaaS products. We often see that software companies fall into three high-level categories when they price their product:

- Those who do not have a very sophisticated view of pricing and charge a “random” price,

- Those who price based on what their competitors’ price, and

- Those who try to price on customer value.

The first group, those who do not have a very sophisticated view of product pricing, typically charging what customers are willing to pay based on some wild guess. In addition, we see examples where the price level and/or price model is based on some historical reason that no one knows or remembers the purpose of having in the first place. With a pricing model like this you might leave significant revenue on the table.

When choosing between pricing based on your competitors’ pricing and customer value, you should seek to do the latter. However, you need to have a product that differentiates you from your competitors to price on value. The more similar you are to your competitors, the more you need to look at their pricing when you price your products.

Suppose a competitor offers the same customer value as you, and has a fixed flat price of 10 000 EUR per year. In this case, it is difficult for you to charge a higher price, independent of the value you generate for your customers. If you, however, have a differentiated product, you can and should try to price based on the value that your customers gain from using your product.

What is value-based pricing?

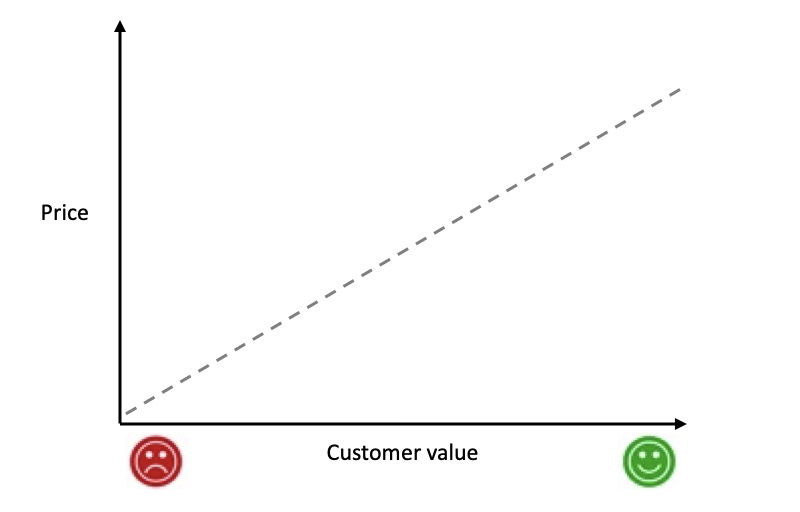

A value-based price model is a price model where the customer pays according to how much value they get from using your product; the more value they receive, the higher price they should spend (and the other way around).

Why should you seek to have a value-based price model?

Using a value-based approach will help you attract new customers and grow and retain your existing customers.

Lower the hurdle for new customers, but be aware of the risks

This approach can help you attract new customers as you are lowering the hurdle to becoming a customer. The less value a customer receives, the less they should pay. Hence, you could charge a lower price initially until they have created value through your product long term.

We see, however, that if there is no financial commitment from the customer upfront, then it could be challenging to get enough buy-in on the customer’s side to really start using the product. It is a balancing act. You want them to have some stake before they start using the product. The best way to figure out what works best is to do some A/B tests and adjust based on the observed results.

Lowering the hurdle also risks attracting customers that do not match your ideal customer profile. Therefore, it is essential to do proper qualifications before introducing the product to new companies.

Scale with your customers over time

As for your existing customers, a value-based price model will enable you to scale with the customers over time. From the customer’s point of view, it is also a great way to share the risk between customer and provider. Instead of paying a considerable sum up-front, the customers start by paying less, hopefully getting value from using the product and growing over time.

How do you measure customer value, and how do you use this understanding in your price model?

When we assess customer value, we typically categorize value into three different buckets:

1. Revenue gain: Can the customer earn more revenue by using your product?

2. Cost reduction: Can the customer reduce their costs by using your product?

3. Emotional gain: Can the customer get some intangible value from using your product?

What type of value you create differs from one software company to another. We often see that software companies create value in all three categories. The perceived value also could depend on the type of persona at the customer.

For example, the CEO could be mostly interested in how the software could help them generate increased revenue. Whereas, the CFO could see more value in how the software could help reduce cost. Whereas the end-users could be mostly interested in the more emotional gain, like how they could reduce stress in their daily lives through using the software.

What drives the value for your customers?

If you understand the value your customers get from using your product, you should seek to understand what variable drives the value for the customers. Often companies use the number of users as a driver for the price, but it some cases looking as your set of features might be more beneficial to scale with the customer over time.

If, for instance, you have a software product that helps consulting companies save 1 000 EUR of costs on every project they run, then it is the “number of projects” you should use as your pricing variable as it is directly correlated with the value that the customers get from using your product.

How to get started with value-based pricing?

If you’re wondering how to get started with value-based pricing, it’s important to begin by conducting market research and understanding your customers’ needs and preferences. Once you have this information, you can identify the key value drivers for your product and develop a pricing strategy that reflects this. You may need to experiment with different pricing models and pricing points to find the right balance between value and affordability.

Conclusion

The importance of getting the price of your SaaS products right cannot be overstated. It can have a significant impact on your revenue, growth, and profitability, and is an essential aspect of any successful business strategy. If you have a differentiated product that provides customers with significant value, then you should consider changing your pricing model to a value-based approach. This approach will allow you to attract new customers and grow and retain your existing customer base, by tying your price model to the variable that drives value for your customers.

As for how much you should increase the price of your products, this will depend on a variety of factors, including your competition, your product’s value proposition, and your target customer demographic. It’s important to be mindful of pricing changes and to communicate these changes effectively to your customers. In our next article, we’ll provide you with a guide to implementing new pricing tactics, including tips and best practices for value-based pricing.

Join other software companies

Get insights on how to scale your business. Learn how to improve organic growth, hire the right team, reduce churn, set your pricing right and accelerate through acquisitions.