State of the Nordic B2B SaaS market

As we enter a new year, we reflect on the state of the Nordic B2B Software-as-a-Service (SaaS) market and look ahead to what 2025 may bring. B2B SaaS continues to play a critical role in increasing productivity through digitization, supported by rapid technological advancements, particularly AI, and the transition to cloud-based software solutions.

This article explores where we are today and what to expect as we move into the new year.

Key trends driving demand for B2B SaaS

We believe there are three key drivers of the Nordic B2B SaaS market: the declining working-age population, the continued shift to the cloud, and the impact of AI.

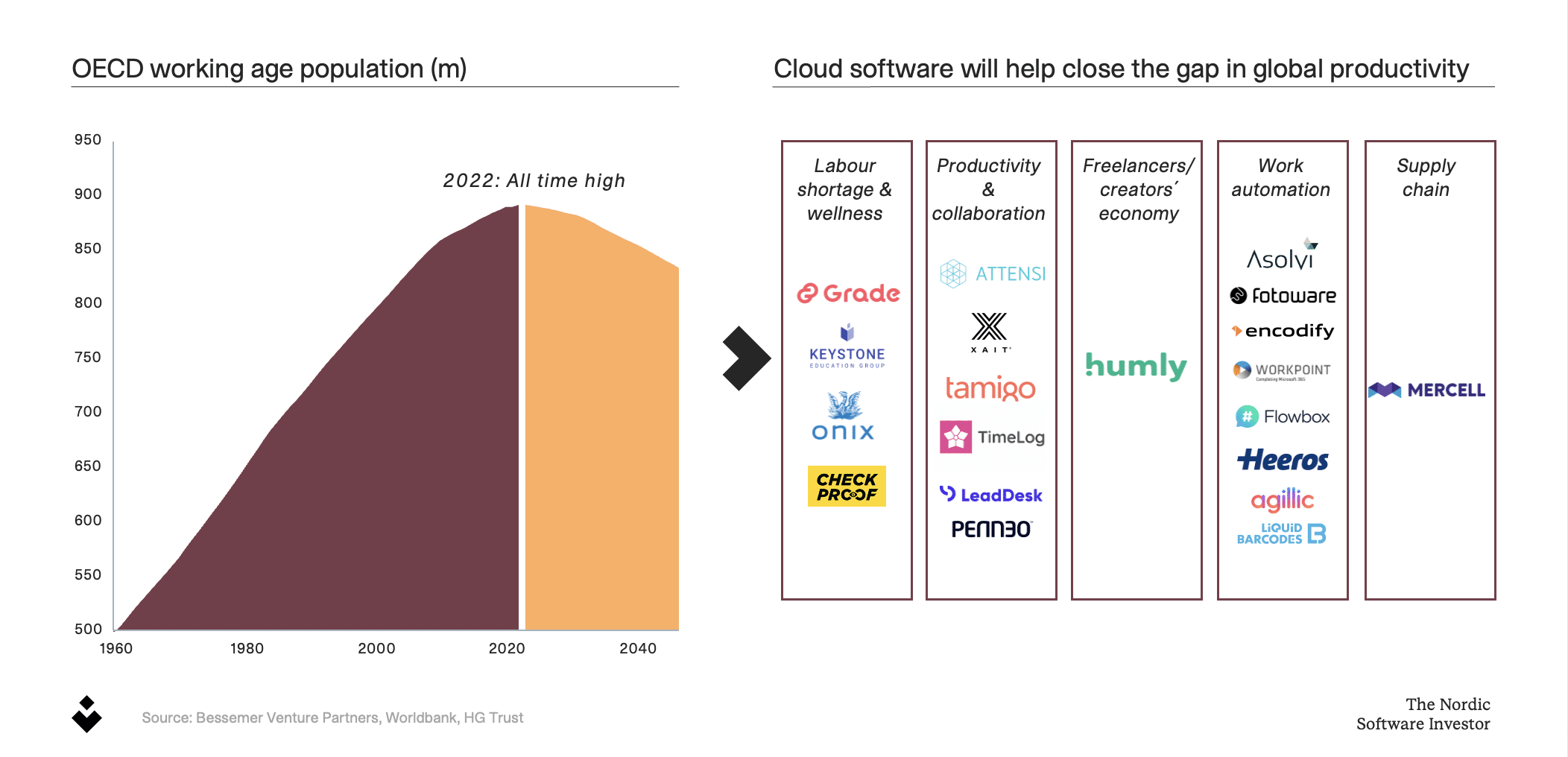

The working age population in the OECD is declining, creating a strong need to increase productivity. Continued focus on digitization to improve productivity will drive demand for software. The Viking Venture portfolio covers important themes across labor shortages, productivity and collaboration, work automation, and supply chain, all well-positioned to solve the global productivity gap.

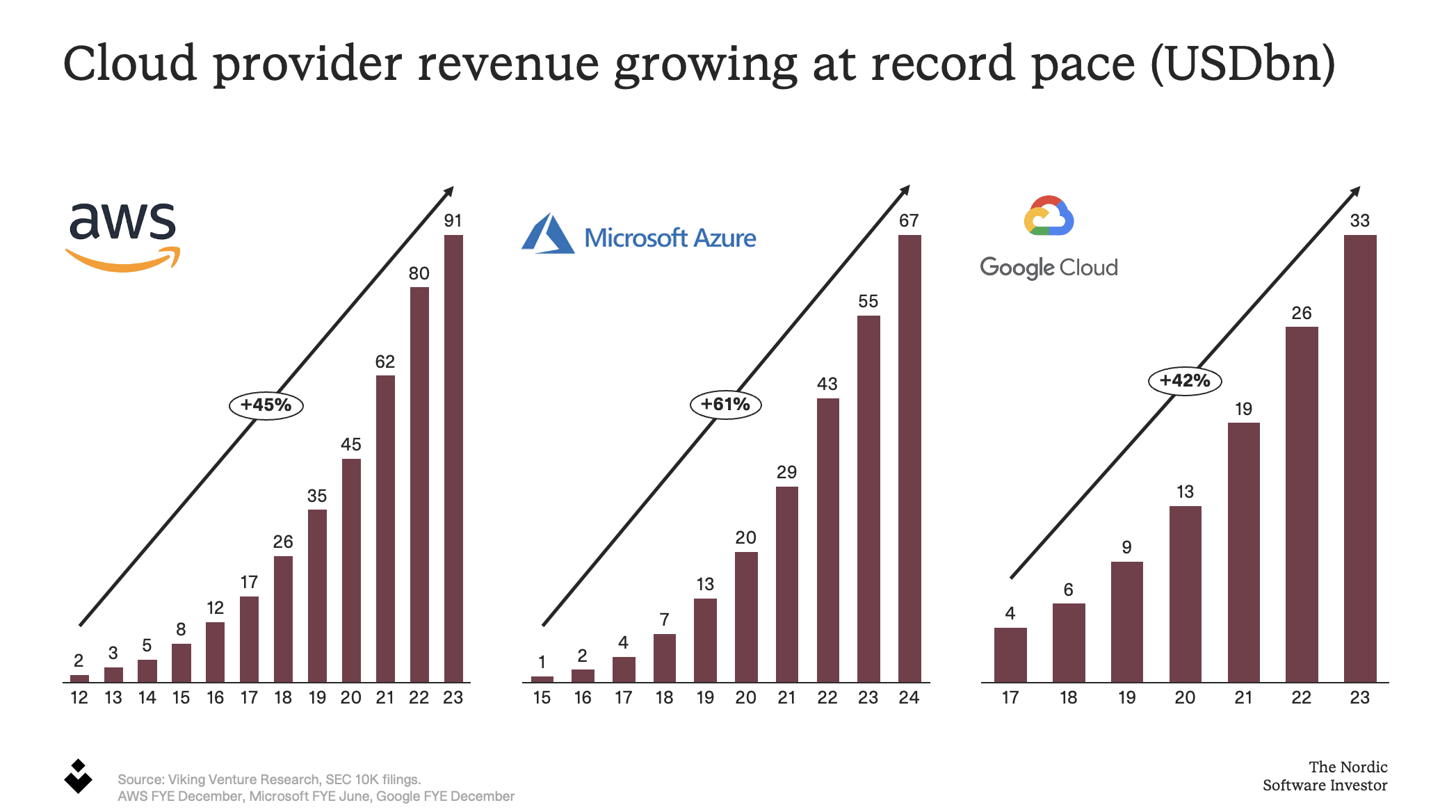

85-90% of software spending in Europe is still related to on-premise software. The shift to cloud-based solutions has just begun and will continue for many years. The need for increased digitization, the continued shift to the cloud, and the impact of AI have driven demand for cloud services. As we can see, the revenue of a selection of cloud providers has grown rapidly over the last 10 years. It continues to grow at a record pace, accelerated by the impact of improvements in AI technology.

We believe Generative AI is transformative and will drive significant demand for B2B SaaS through improved software solutions. At the same time, AI yields productivity gains in software companies from software development to sales. The impact of AI is already making its mark on productivity improvements in large technology companies. In December 2024, the CEO of Klarna told Bloomberg TV that the company “stopped hiring a year ago to replace workers with AI”.

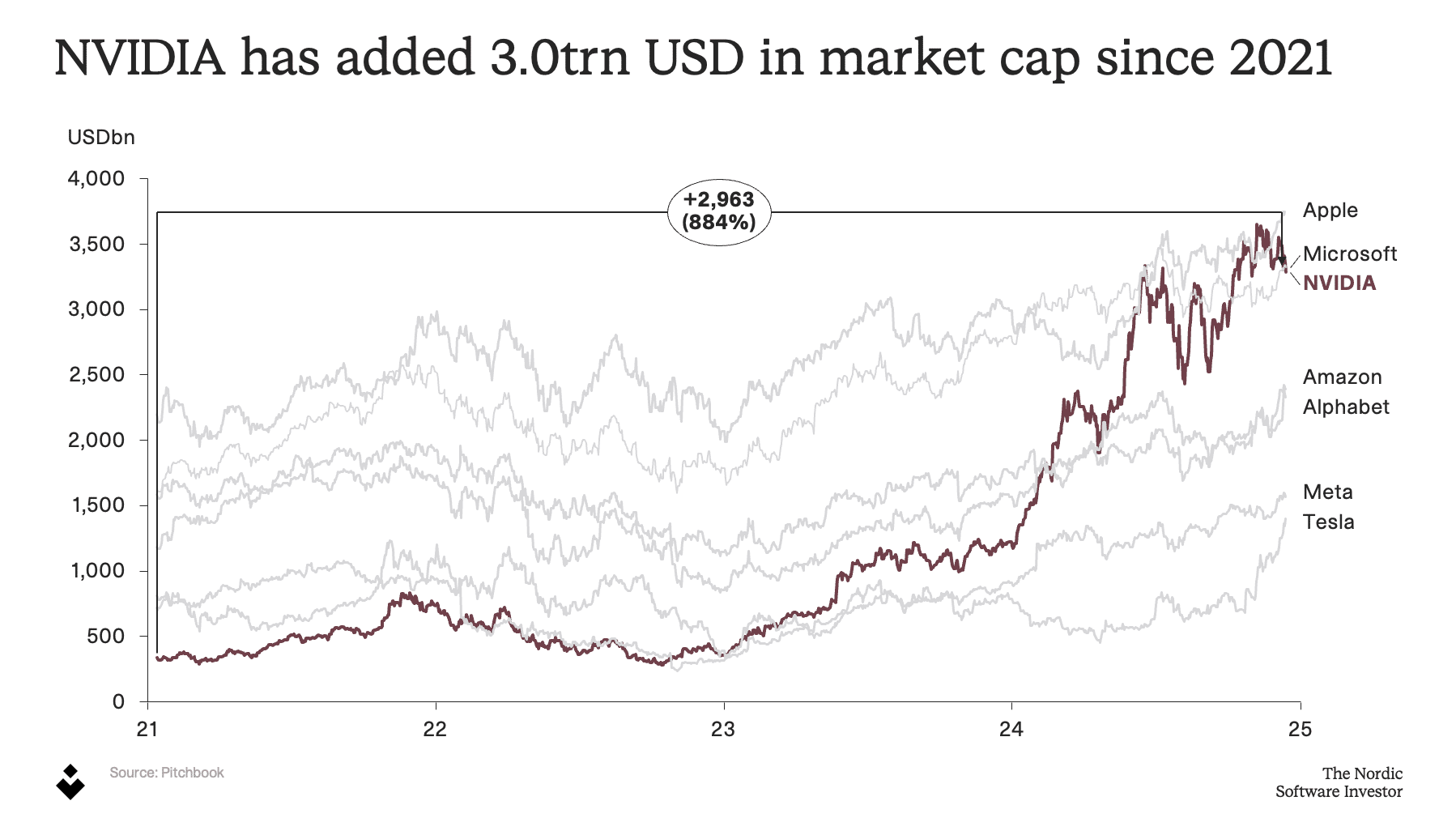

Every software company should treat the technology with a sense of urgency to stay ahead. The impact of the technology can be readily seen, for example, in the market capitalization of NVIDIA, which holds a significant share of the market for hardware to train AI models. The company has added a staggering 3.0trn USD in market capitalization since 2021, moving from the bottom to among the top of the “Magnificent 7” company list.

Valuation of the Nordic B2B SaaS Market

Leading up to 2024

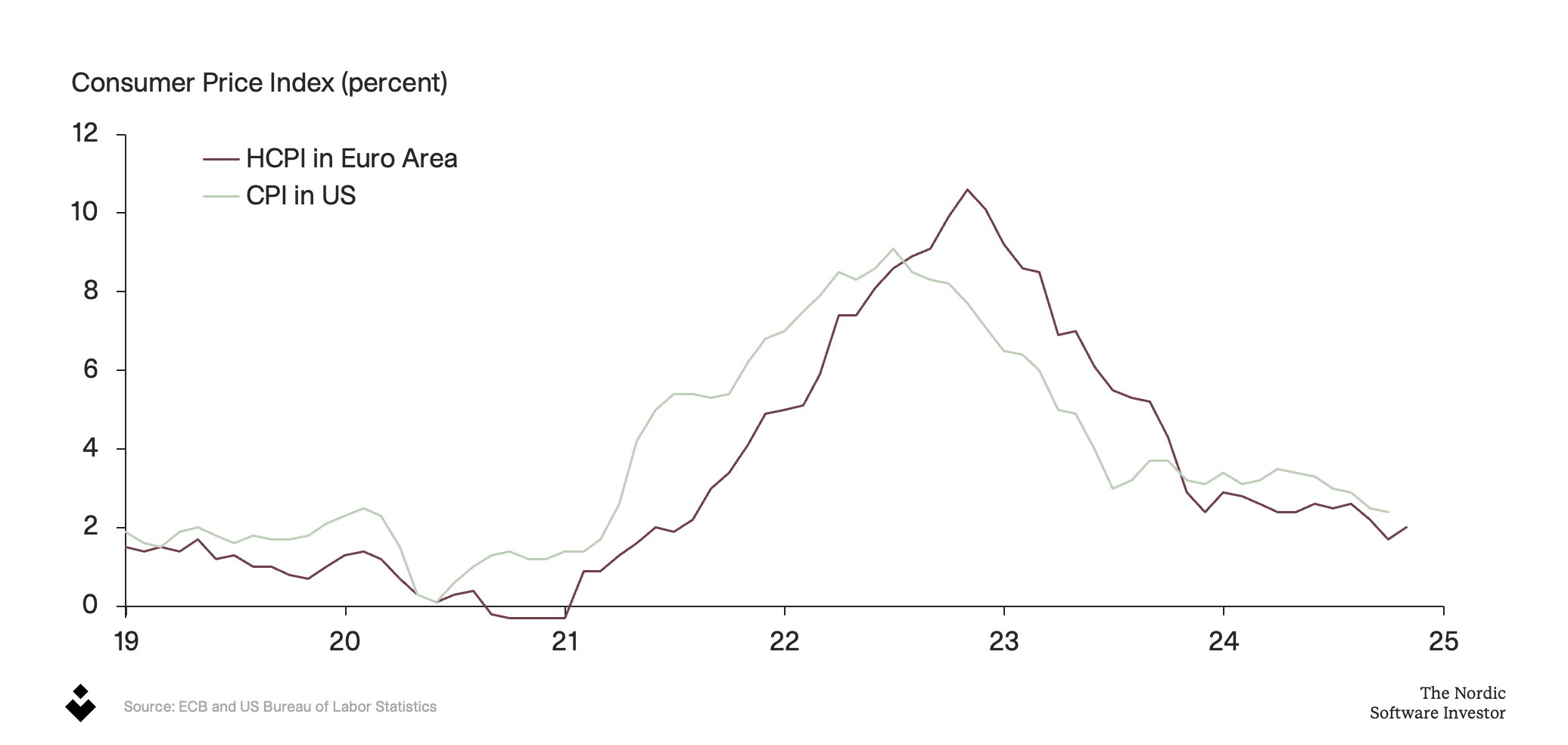

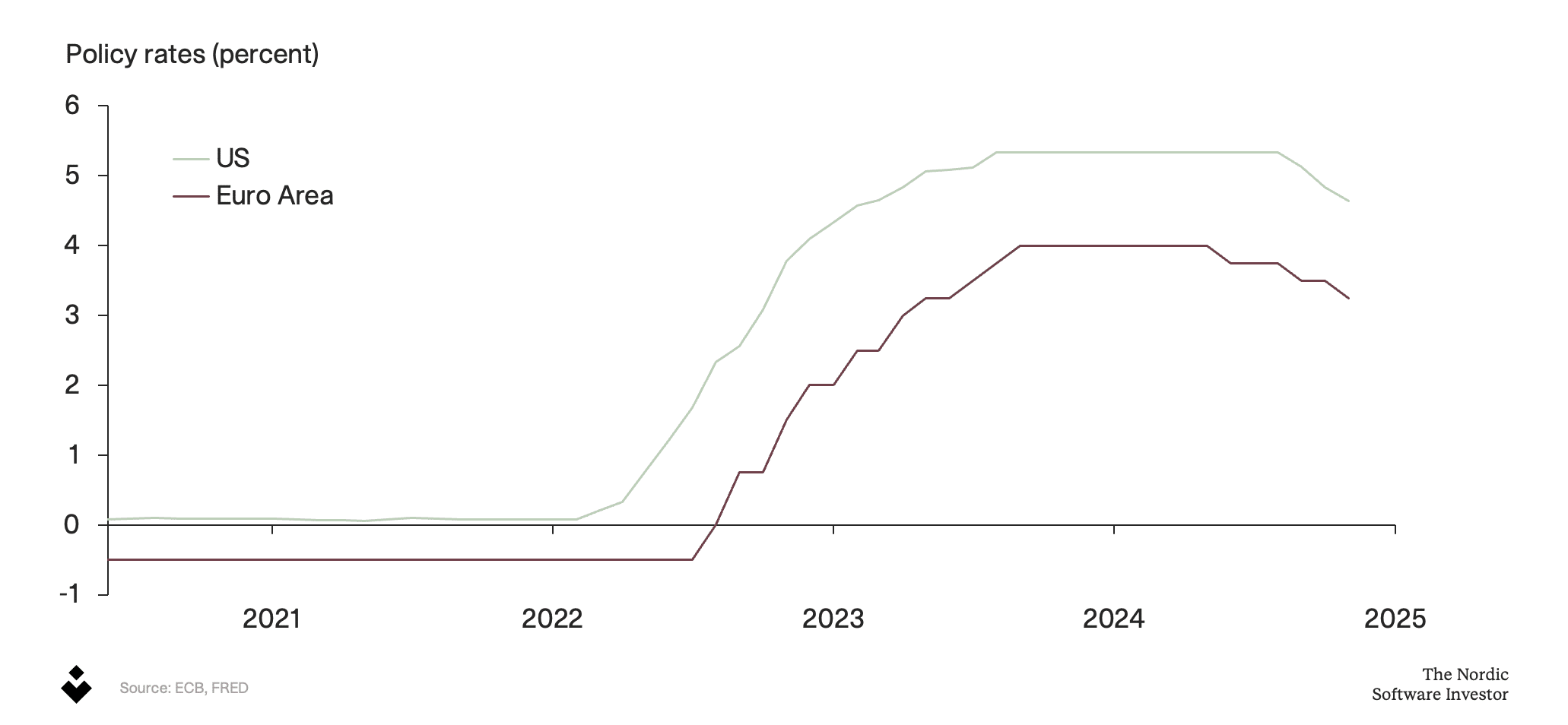

To understand the current valuation of Nordic B2B SaaS companies, we must first look at the years leading up to 2024. After low policy rates down during the pandemic, inflation increased rapidly up to the end of 2023 in both the Euro Area and in the US. As a result, central banks responded by raising policy rates.

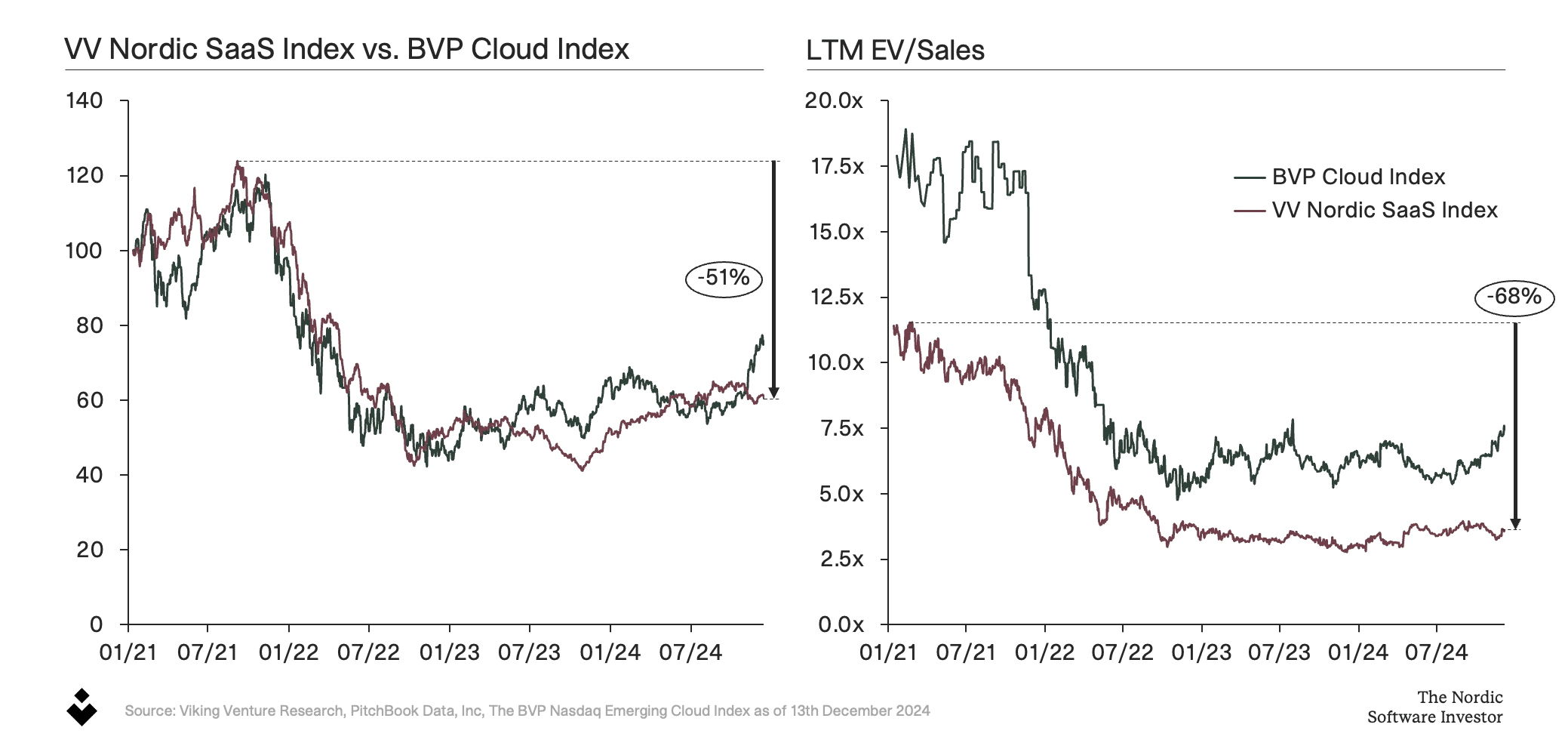

When policy rates increase, the value of future cash flows decreases through the impact on the discount rate. Hence, market values and valuation multiples decrease. As we can see in both the Bessemer Venture Partners Cloud Index (BVP Index), which tracks listed emerging cloud companies in the US, and our own Viking Venture Nordic SaaS Index (VV Nordic SaaS Index), which tracks listed B2B SaaS companies in the Nordics, the market valuations are down +50% from the peak. Similarly, the Enterprise Value (EV) to the last twelve months (LTM) sales are down +60%.

Where are we today?

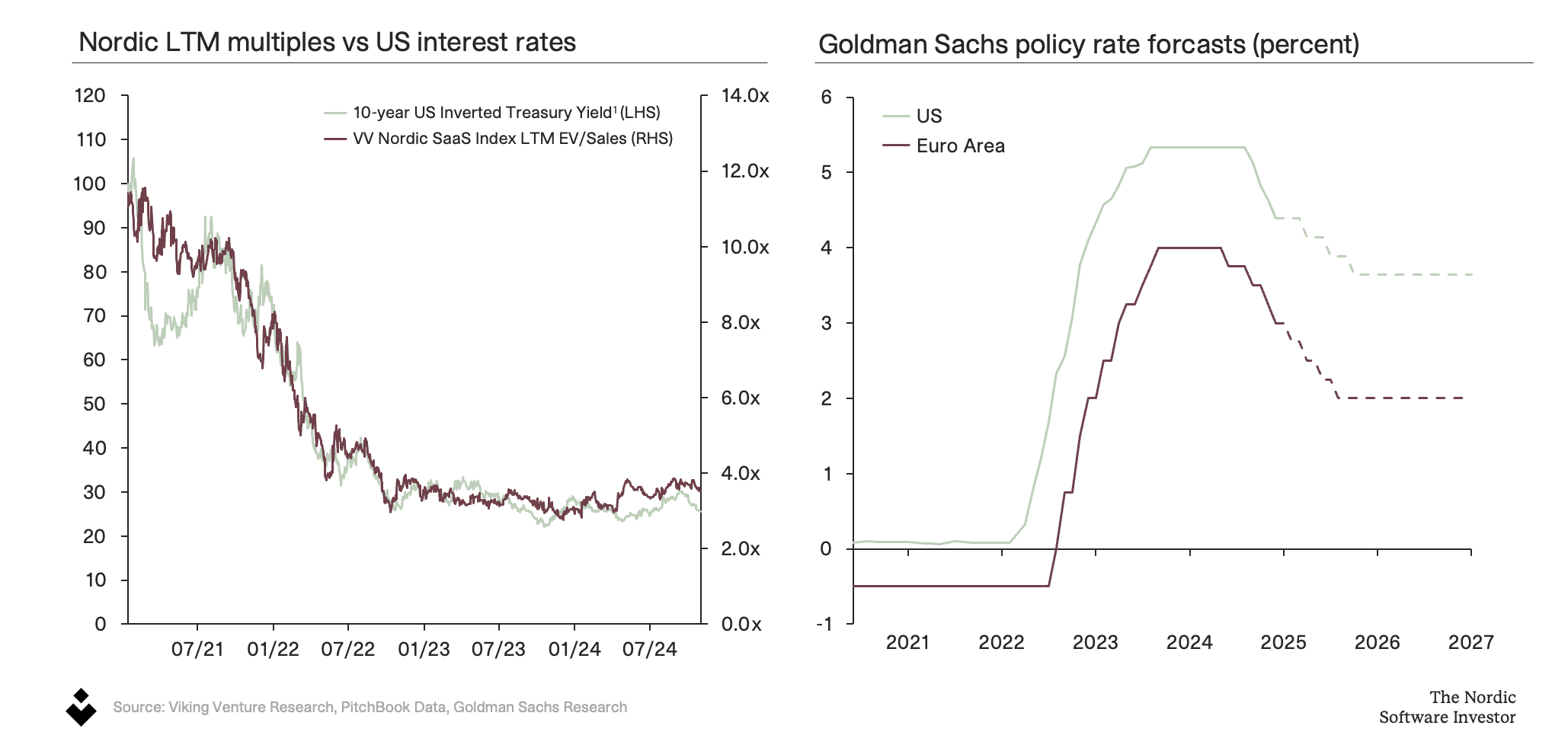

The Nordic B2B SaaS LTM EV/Sales multiples are strongly correlated with the long-term interest rates in the US, as seen in the graph below. The long-term interest rate graph is inverted, meaning that the valuation multiples decrease when the interest rates increase. This means that long-term interest rates will decline when policy rates decrease, leading to higher valuation multiples.

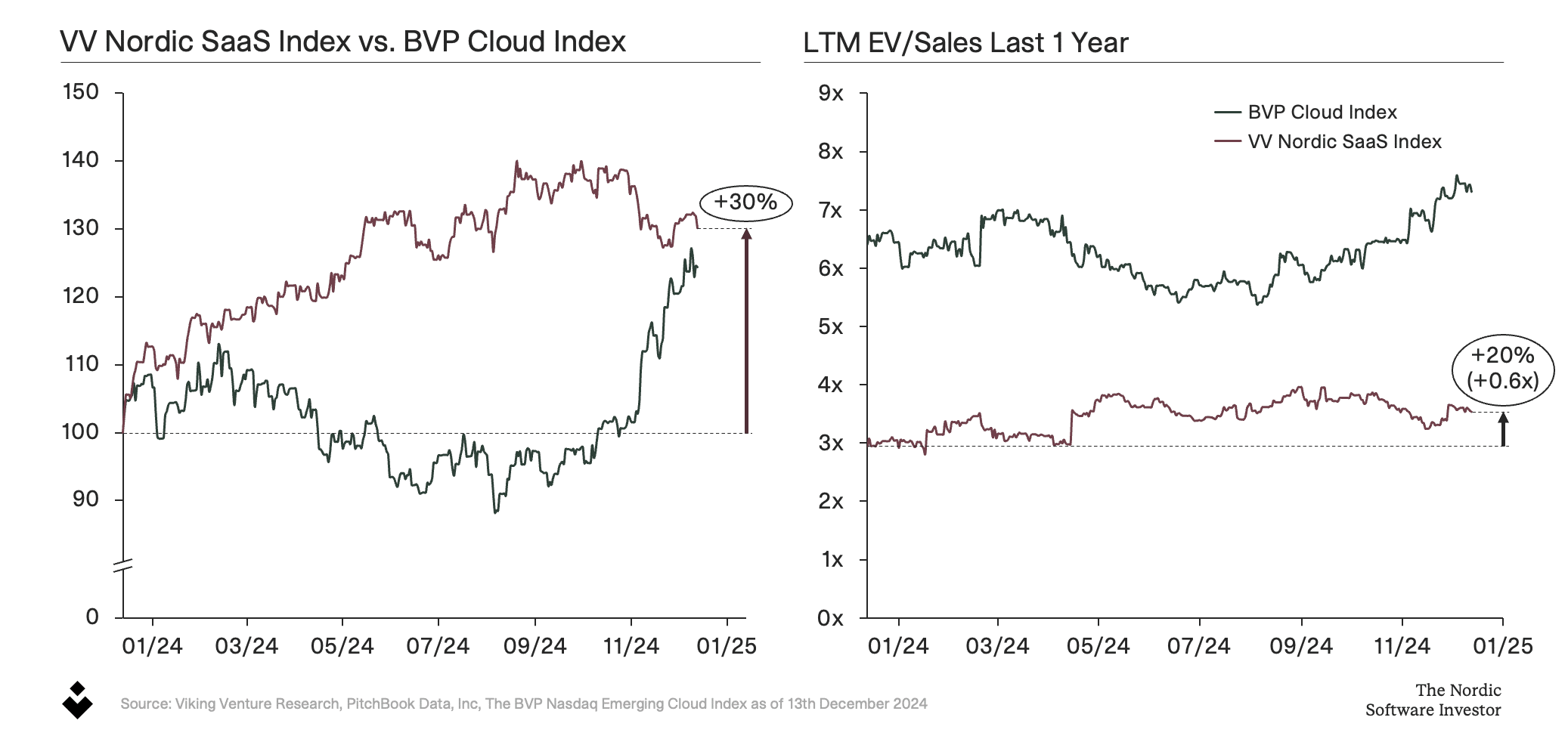

During 2024, inflation has normalized, and we have seen initial interest rate cuts in Europe and the US, with additional rate cuts expected. As a result, both the VV Nordic SaaS index and valuation multiples are up +20-30% year-to-date.

What does this mean for the Nordic B2B SaaS Market?

Attractive market for new investments

Low valuation multiples give an attractive market for investing in new companies and partnering with founders. In the private market, buyers and sellers are adjusting to the new valuation levels and we see increasing deal volumes, although from low levels. At Viking Venture we have successfully partnered with two exciting founders in 2024, Håkan Holmgren at CheckProof and Miikko Jaatinen at Jamix. We believe raising capital for growth purposes should be done according to the needs of the business, irrespective of market valuations and cycles. Both CheckProof and Jamix deliver a mission-critical software for their customers and see great opportunities for continued expansion in new regions.

As the pricing of listed companies decreased, Viking Venture invested in several listed companies to take advantage of the reduced valuations in 2022 and 2023, and we continue to see a significant interest in public-to-private (P2P) transactions in the Nordics in 2024. Indeed, two of our portfolio companies, Heeros in Finland and Penneo in Denmark, received Tender Offers in November 2024 at significant premiums of 52% and 110% premium to the last closing price, respectively, reflecting the robust performance of the companies. The Tender Offer for Penneo represents an all-time high premium on the Danish stock exchange.

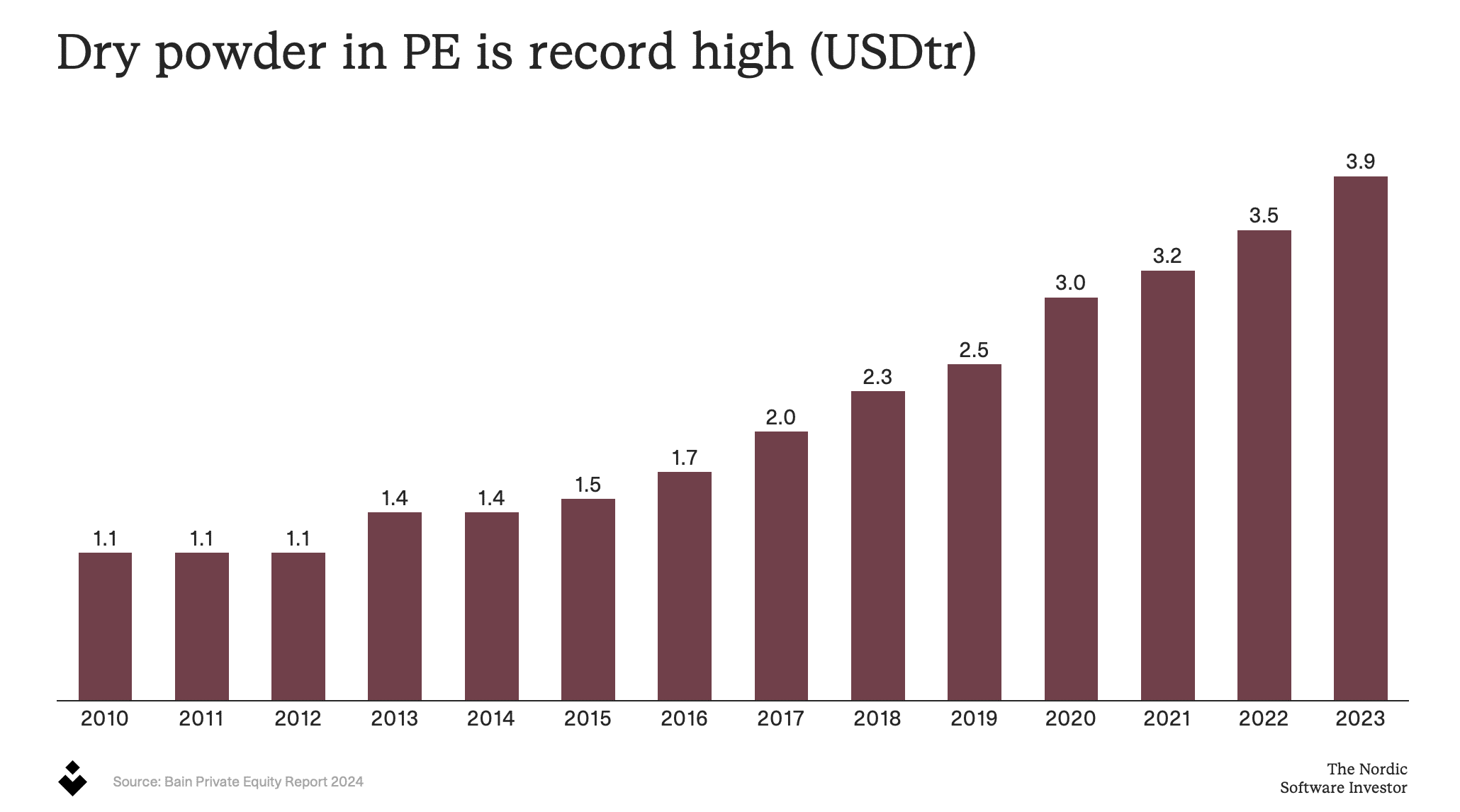

The public offers are a continuation of the trend that kicked off in 2022 and 2023, when four previous Viking Venture portfolio companies were acquired through P2P transactions (EcoOnline, Ørn Software, Mercell and House of Control). The trend of P2P transactions is driven not least by all-time high dry powder in PE of 3.9 trillion dollars.

Slower market for exits

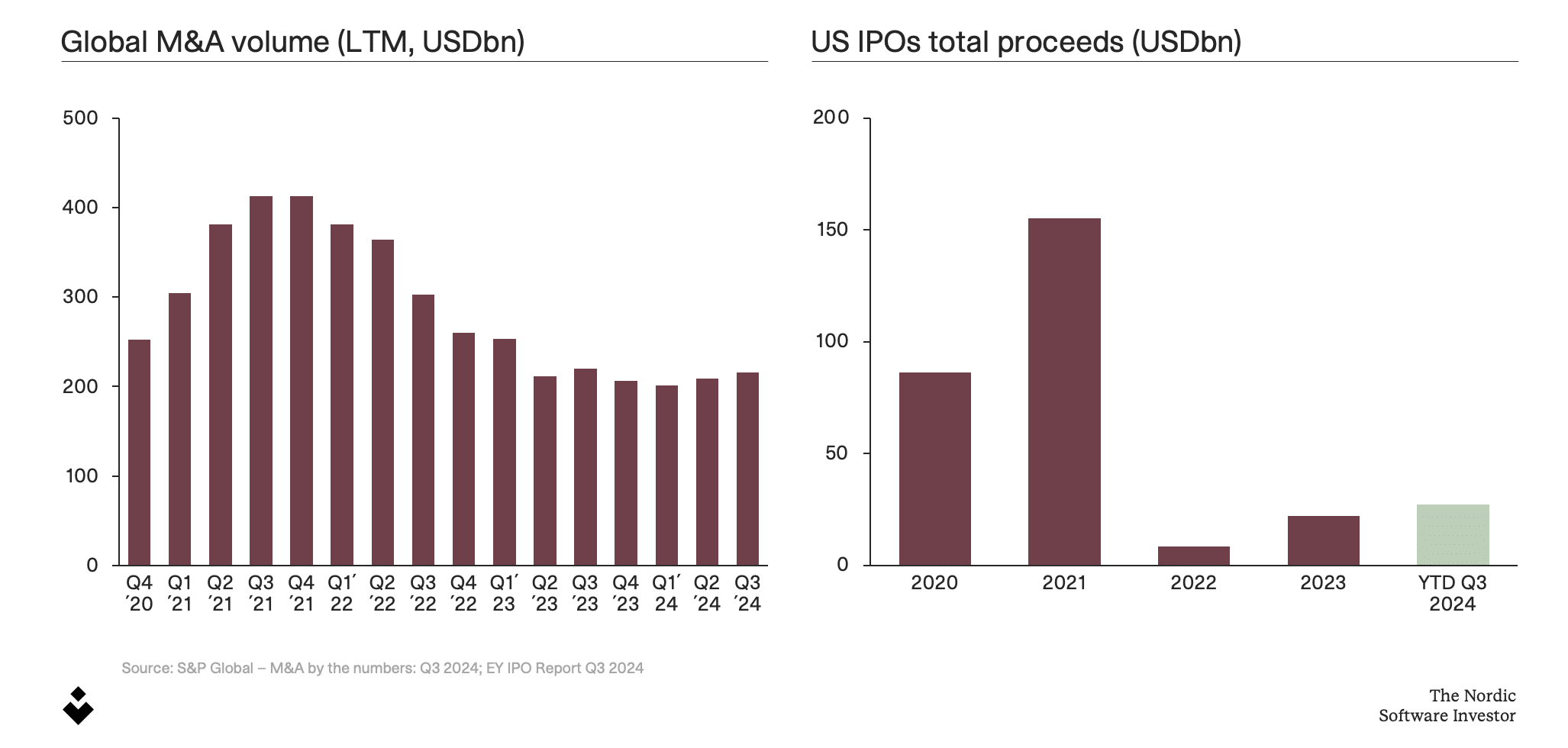

While lower multiples result in an attractive market for investing in new companies, it also leads to a slower market for exit activity. Global M&A volume is markedly down, and the value of US IPO proceeds has dropped off, although we see an uptick in both so far in 2024.

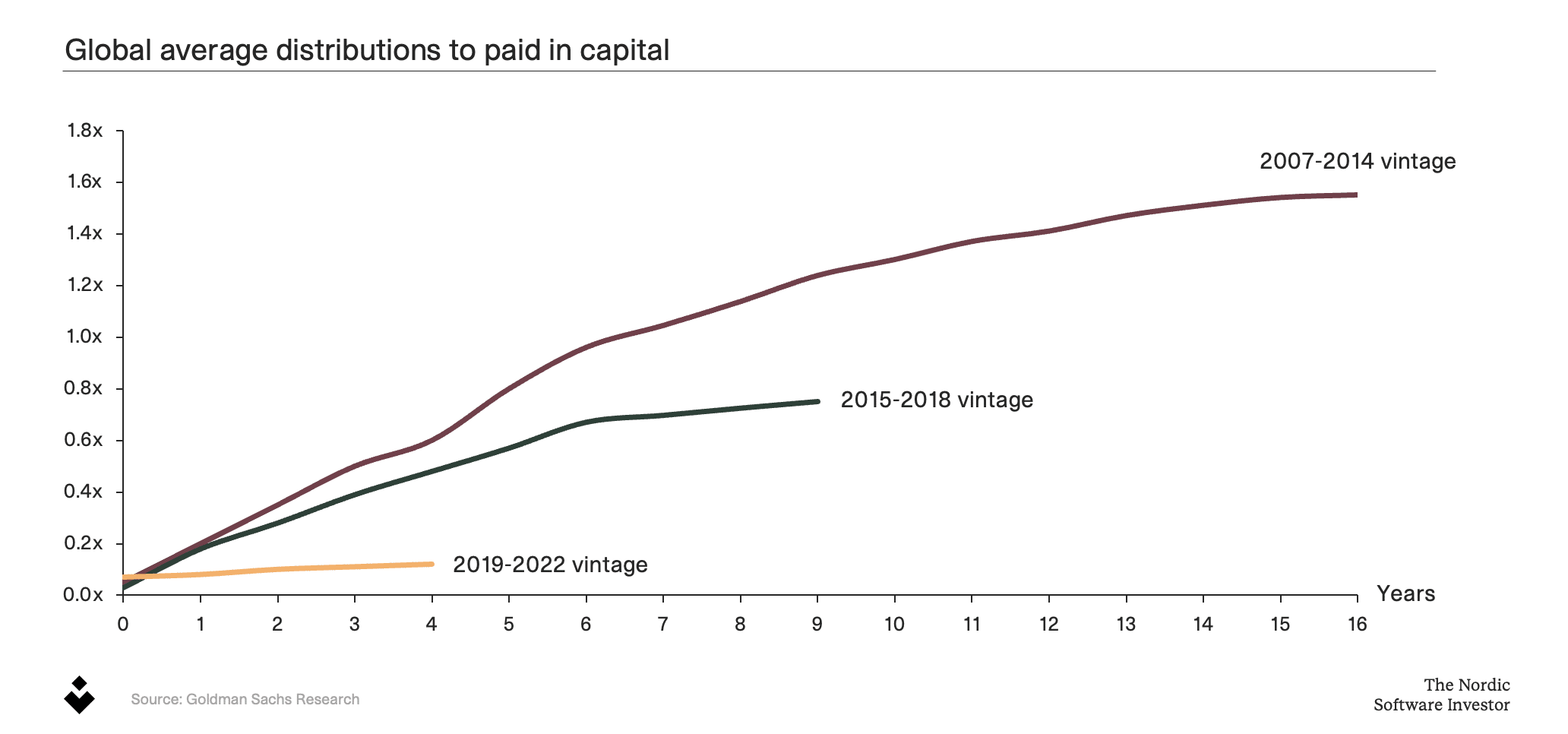

Many private equity funds will have invested in companies at higher multiples and hold on to their investments while waiting for a normalization of interest rates and valuations. This can be seen in the distributions to paid in capital (DPI) of the most recent private equity fund vintages from 2019-2022, which is markedly lower than earlier vintages.

What is the outlook for the Nordic B2B SaaS market in 2025?

Looking ahead, we are excited about what 2025 has in store. Global policy rates are expected to decrease further in 2025, with the latest Goldman Sachs forecast indicating the Federal Reserve will decrease rates down to a terminal level of 3.5-3.75% in the US, with sequential cuts in March, June, and September 2025. Given the strong correlation between interest rates and valuation multiples, we expect an increase in valuation multiples and valuation of Nordic B2B SaaS companies. Increased valuation will increase the number of companies seeking an exit or capital for further growth. At the same time, the IPO markets will open while dry powder in private equity will remain at record high levels. Consequently, we expect to see a boost in IPO and M&A activity once long-term interests reach a sufficiently low level. As always, timing is the crucial question for everyone to consider.

Even if the future valuation of Nordic B2B SaaS companies looks promising, risks of external shocks and geopolitical shifts remain. Companies must adopt a balanced approach, focusing on profitability and scalability to keep resilient through the cycles. For our portfolio of B2B SaaS companies, generative AI will be critical in this respect. In our upcoming article series, we will look at a selection of our companies and how they work with AI to stay ahead in their markets.

Sign up to receive our weekly Viking Venture Nordic SaaS Index here

Abbreviations

- SaaS – Software-as-a-Service

- B2B – Business-to-Business

- AI – Artificial Intelligence

- trn – trillion

- M&A – Mergers and Acquisitions

- IPO – Initial Public Offering

- PE – Private Equity