Viking Venture has 16 software-as-a-service (SaaS) companies in our portfolio. This gives us a unique opportunity to track the most important SaaS KPIs and gives us and our portfolio companies access to highly relevant benchmarks across the portfolio – the Viking Venture KPI Dashboard. We provide you with a Nordic edition of State of the Cloud.

Written by: Martin Senning Eriksen and Hege Kvitsand, respectively Senior Investment Associate and CFO at Viking Venture

Track key SaaS metrics and KPIs and make data-driven decisions

There is no doubt that 2020 was a special year and that Covid-19 had (and still has) a major impact on the world of business. For our portfolio companies it was in the initial phase all about making sure everyone was safe and healthy, but they turned around quickly to find the silver linings. Tracking key SaaS metrics and KPIs to make data-driven decisions is at least as important during difficult times as in good times. We believe that by giving each company their own KPI Dashboard, they can see what is working well and what needs to be improved in their own business. They also see which companies are top performers in the portfolio and can reach out to understand what they are doing that works so well.

In our article Why we are obsessed with tracking key software-as-a-service metrics and KPIs we gave insight into:

- Important SaaS KPIs related to growth and profitability and why you should measure them

- How to ensure a risk adjusted growth profile

- How your company is performing compared to 16 other SaaS Scale-up companies in the Nordics

In this article we will provide you with benchmark data on how our portfolio did in 2020. You will gain valuable insight into how your company performed compared to the largest community of B2B SaaS companies in the Nordics, with a keen focus on growth, profitability, customer acquisition cost and sales efficiency.

Viking Venture KPI Dashboard

Just a quick reminder on what the Viking Venture KPI Dashboard is for those of you who have not read the previous articles. The dashboard is divided into three sections to make sure we don’t end up discussing sub optimal solutions.

- Growth and Profitability

- Customer Acquisition Cost and Sales Efficiency

- Coverage Model & Sales Process

So how did our portfolio perform in 2020?

1. Viking Venture KPI Dashboard: Growth and Profitability

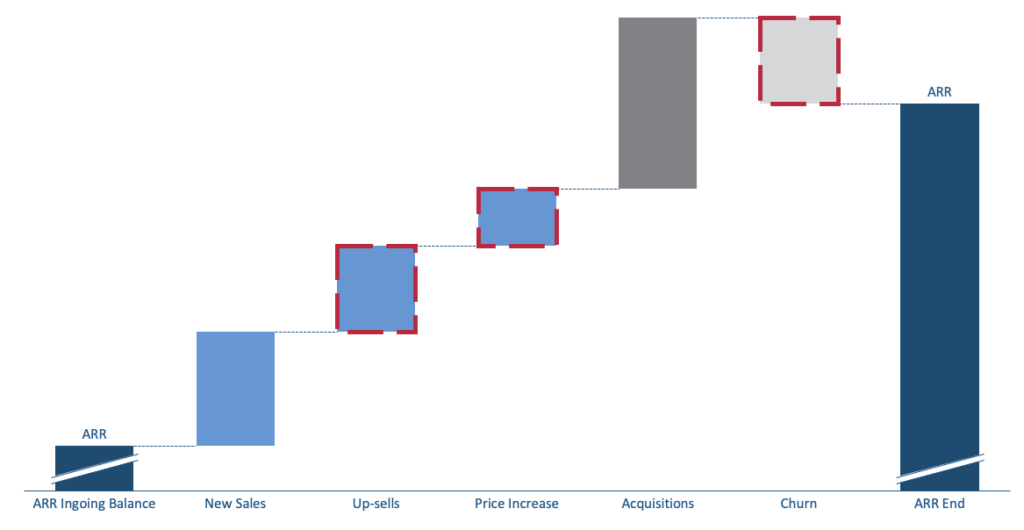

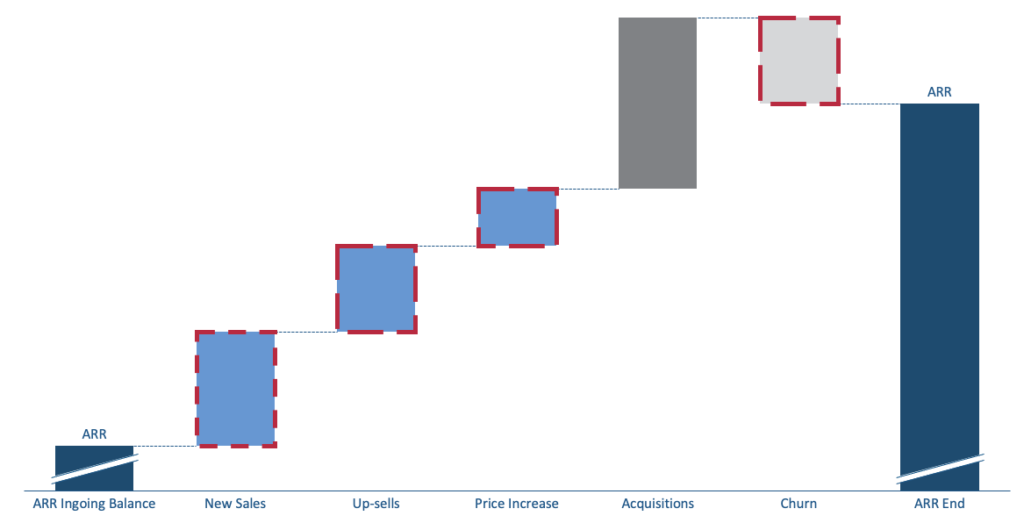

We find it very important to distinguish between organic and inorganic growth to understand the underlying drivers. The average total ARR growth in 2020 was 40%, which includes acquisitions. This is an important driver for growth for many of our portfolio companies and during 2020 we did 17 add-on acquisitions across our portfolio. Average organic growth was 20%, while our top performer grew organically by 51%.

As the table shows our top performers have delivered an outstanding year. These two companies are great examples of companies that really masters organic growth and acquisitions.

The average for Rule of 40 was 31% in 2020. This KPI tells you if you have a healthy balance between growth and profitability, which was especially important during 2020 and covid-19.

In the following section we will go through our Growth and Profitability KPIs

ARR Growth – the biggest value driver of B2B SaaS companies

- Total ARR Growth including acquisitions

- Organic ARR Growth excluding the effect of acquisitions

- New sales ARR Growth, which only includes new sales

We are very fond of the ARR Waterfall model to illustrate the ARR movements in terms of new sales, up-sells, price increase, acquisitions and churn.

Churn

Churn can be measured in terms of ARR and # of customers and both are important to measure and track. Knowing your churn is important for forecasting, but the real value lies in understanding why customers choose to cancel their subscriptions. We have run several projects with our portfolio companies to understand the root causes of churn and improve the value proposition.

Want to learn more on how to fight churn? Take a look at our presentation on Six Initiatives To Keep Your Customers

Know your churn, but make sure you understand your Renewal Rate as well!

Renewal Rate = Total value of contracts renewed / Total value of contracts up for renewal

Renewal Rate: why is this metric so important?

Churn might be artificially low if it is based on the total customer base and not just the ones with contracts up for renewal. This especially applies to fast-growing companies, or companies with customers on longer contracts. This is due to the fact that many of your customers might not be able to churn even though they may wish to. It is in other words a great measure of customer satisfaction. It indicates healthy and profitable growth by telling us what percentage of our customer base actively chooses to renew their subscriptions when given the chance.

- Renewal rate can be measured in ARR and # of customers

- Only looks at those customers who are in fact able to churn

- The difference between retention and renewals:

- Retention = Measures the share of customers who continue their subscription, automatically or by choice

- Renewals = Customers who by choice renew their contracts when they are able to resign

- Segmentation is important to uncover root cause of low renewal rate

Rule of 40

There is a need in every business to understand the balance between growth and profitability. This KPI tells you whether or not you have managed to find an optimal balance between growth and profitability. It is widely accepted that if the sum of your organic growth rate and EBITDA margin is 40% you have reached an optimal balance between growth and profitability. Let’s look at some examples:

- ARR organic growth 40% and EBITDA margin 0%

- ARR organic growth 20% and EBITDA margin 20%

- ARR organic growth 10% and EBITDA margin 30%

We look at the rule of 40 to ensure our companies have a risk adjusted growth profile, which helps decide when to hit the accelerator and when to grab on to the brakes.

SaaS Gross Margin

SaaS Gross Margin = Revenue – SaaS COGS / Revenue

Why do we measure SaaS Gross Margin?

Traditional Gross Margin for software companies does not show a true picture of what the company retains of sales income after incurring all direct costs, therefore we need to adjust this to show SaaS Gross Margin. This KPI helps a company understand the scalability of their business, and when broken down can show which products/services contribute the most to the bottom line

SaaS COGS = Cost of Goods Sold = All ‘variable costs’ attributed to delivery. This includes hosting, third party costs, support and other direct costs. Costs attributed to retention of current customers in the Customer Success department should also be included

2. Viking Venture KPI Dashboard: Customer Acquisition Cost (CAC) and Sales Efficiency

The average net retention across our portfolio was 102%. This means that our portfolio’s revenue would still grow without gaining a new customer in 2020. The top performer had a net retention of 115%.

Across our portfolio the average CAC payback was 19,5 months. This KPI is based on a blended work force. Some of our most sophisticated companies when it comes to KPI reporting calculate this KPI for new sales, customer success, in addition to fully ramped and workforce under onboarding. This granular view gives much more insight than just the blended KPI.

In the following section we will go through our CAC and Sales Efficiency KPIs:

Net Retention

Net retention is known to be the most comprehensive churn metric as it tells the complete revenue story of the installed base of customers. What this means is that it shows you what your company’s top-line revenue would be if you didn’t gain a new customer ever again. In other words, it captures the negative impact of lost customers, but also the positive impact of price changes, up-sells and cross-sells.

SaaS Quick Ratio

The SaaS Quick ratio tells us if our revenue is growing faster than our churn, but also tells us if we are growing efficiently or inefficiently. When growing inefficiently, high churn will eat away at our growth potential, which is also the reason that this KPI is called the ‘leaky bucket issue’. This KPI compares your revenue growth over a certain time period to your revenue shrinkage in that same period.

CAC Payback

We measure this because it is the primary KPI connected to sales scalability. If CAC payback is more than 12 months, growth will require capital. When we segment this KPI based on customer type, we can focus our efforts where we are the most effective.

- CAC encompasses all the sales and marketing costs that a business needs to spend to acquire a new customer and sell to existing customers

- Marketing, meeting bookers, sales costs (new sales & customer success)

- CAC payback tells us how many months it takes to recoup our customer acquisition costs

- For a more granular view it is important to segment based on type of customer, and fully ramped/blended sales force

LTV/CAC

In addition to the customer acquisition cost, we like to look at the Lifetime Value (LTV). The reason for this is simple, it is important that the lifetime value of a customer is higher than the cost of acquiring that customer.

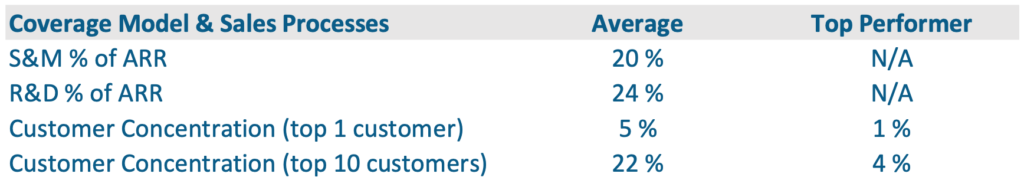

3. Viking Venture KPI Dashboard: Coverage Model

When it comes to customer concentration, the average in terms of ARR from top 1 customers across our portfolio equals 5% of the total ARR. This tells us that the revenue is well distributed among the customer base and that there is no substantial risk. We see the same trend for the top 10 customers. The average here is 22% of the total ARR.

The average for S&M costs as a percent of ARR and R&D costs as a percent of ARR is, respectively 20% and 24%.

Customer Concentration

Customer concentration is a measure of how total revenue is distributed among your customer base. High concentrations carry substantial risks for businesses. Losing a customer can have a devastating effect on revenue, customers have more influence on pricing, and they can divert a disproportionate share of resources.

When measuring this in the Viking Venture portfolio we like to look at the ARR from the top 1 customer and top 10 customers of total ARR.

- Top 1 Customer = x %

- Top 10 Customers = y %

Keep in mind that some industries tend to have higher customer concentrations than others, for example retail sales typically generates low concentrations while industries with a high number of enterprise players generate high concentrations.

Sales & Marketing costs and Research & developing costs of total ARR

We measure this to understand how much our companies spend on product development and sales processes to continue growth. This KPI is especially interesting as a benchmarking exercise between the portfolio companies and up against the other KPIs we are measuring.

- Companies with high S&M costs % of ARR reinvest a significant portion of their profits back into sales and marketing as an investment in their continued growth

- Companies with high R&D costs % of ARR reinvest a significant portion of their profits back into research and development as an investment in their continued growth

The benchmark for these two KPIs are approximately 30% according to Insight Partners’ Periodic Table, based on performance data across their private and public SaaS companies. Insight Partners is one of the leading software investors in the world and share a lot of great knowledge on their website.

In this article we have provided you with benchmark data on how our portfolio did in 2020. Hopefully you have gained some valuable insight into how your company performed compared to the largest community of B2B SaaS companies in the Nordics.

Curious for more insights from Viking Venture?

Follow us on Linkedin and sign up for our newsletter

Ingvild Farstad, Community and Marketing Manager, Viking Venture

Ingvild manages Viking’s software community, which offers a unique environment for our portfolio companies to exchange knowledge, ideas and experiences within the most important processes for software companies.