Is your company a fit for Viking Venture’s Portfolio?

Are you curious as to what companies Viking Venture invests in? And what can you expect from a software investor like Viking Venture? Our focus is solely on Nordic business-to-business (B2B) software companies. A niche investment focus that gives us in-depth experience with software companies. We aim to help ambitious founders and management teams scale internationally. Continue reading to see if Viking Venture fits your business well.

Header image (from left): Erik Fjellvær Hagen, Managing Partner at Viking Venture and Jostein Vik, partner at Viking Venture

Find the right investor for you

Choosing the right investor is equally important as raising equity for the company. Defining the “right” investor is a subjective call, depending on what stage the company is in. As well as, what challenges you need to overcome. If your strategy for the next period states that you will perform cross-border M&A in specific markets, attracting an investor with that expertise will make sense. If you need help with your sales processes, an investor with a demonstrated history of establishing solid sales processes for businesses like yours could be preferable.

At Viking Venture, we help Nordic software companies scale. That’s all we do. When scaling software companies, we are typically involved in business modeling and pricing, the commercial engine (marketing, sales, and customer success), recruitment of key roles, acquisitions, debt & equity financing, and exit processes.

What type of companies do we invest in?

Since 2014, we have only focused on B2B software companies. We typically look for Nordic B2B software companies with revenues or contracted annual recurring revenue of 2-15 million euros. We like companies with significant international growth potential that can document historical growth. When we list growth potential as one of our criteria, we do not necessarily talk about scale-ups with unicorn potential. We are interested in companies which have been around for a while with slower growth rates as well, as we know what levers to pull to increase that growth. At Viking Venture, we have much experience in turning low single-digit growth into high double-digit growth by implementing our playbooks and utilizing our operational excellence team.

Diverse approach to international expansion

A company does not need to show a track record of international success to be of interest to us. However, we want evidence that the product can successfully launch across borders. A typical investment in the Viking Venture portfolio has focused merely on its domestic market at the time of investment. Together, we determine what international markets are attractive before deciding on the global expansion strategy. In our experience, a combination of organic and inorganic expansion should be considered as acquiring other companies (“M&A”) carries a much lower risk of success than expanding pure organically, and it takes much less time.

Software supporting work processes

Furthermore, we like companies with products that support important work processes for their customers. In such a case, your product becomes “need to have” rather than “nice to have”, which increases stickiness. And stickiness is good. If you have a sticky product and get your processes and workflows within Customer Success right, you will experience churn at a comfortable level. Adding to this, it is less likely that customers will churn in case of an economic turndown. Having a sticky product forms a great foundation to experiment with price & packaging which ultimately will boost your net revenue retention and grow your ARR.

Tech Investor Landscape in the Nordics

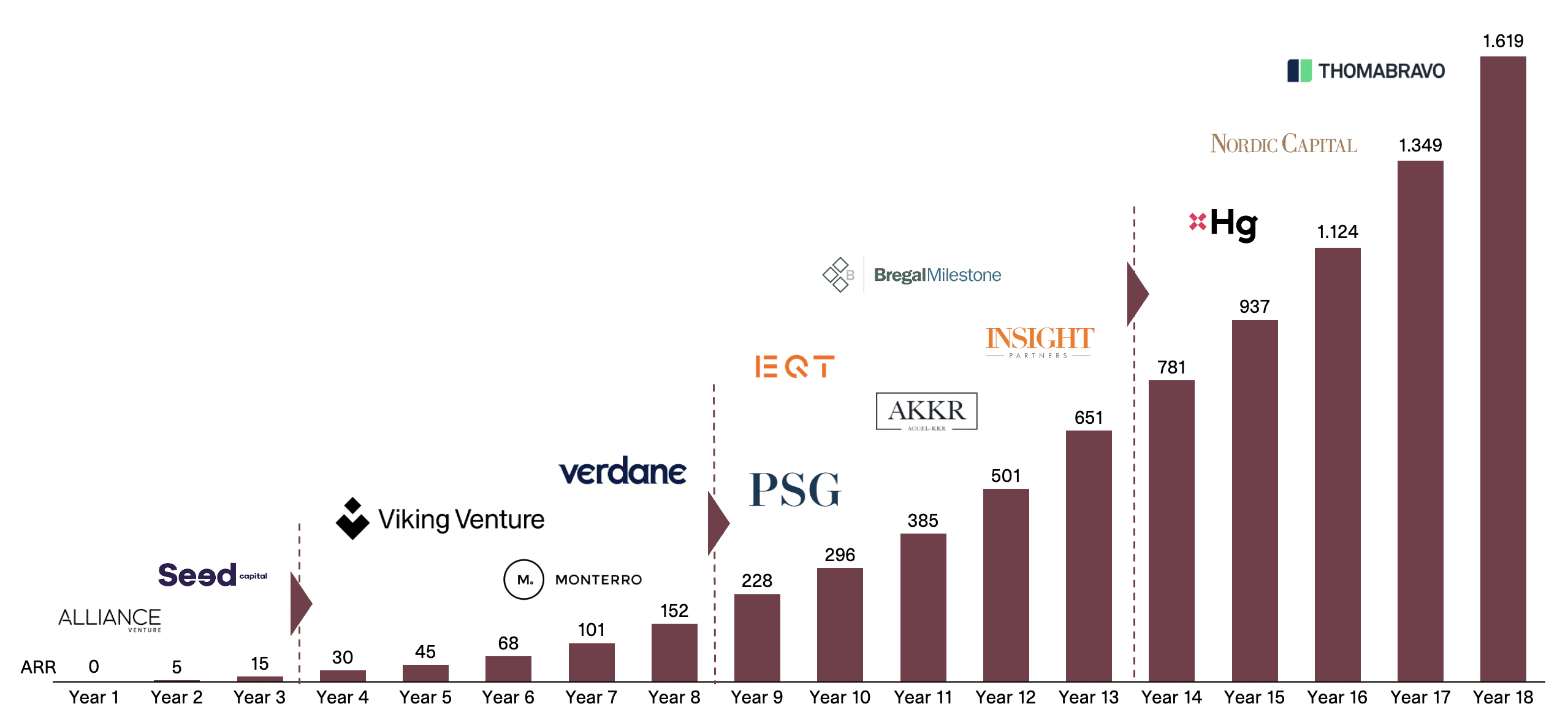

A typical challenge in business expansion is the need for more focus. Directed focus over time gradually leads to expertise within a specific area. This principle guides our interactions with portfolio companies, and we hold ourselves to the same principle. This underscores our exclusive investment in B2B software companies. Leveraging a comprehensive toolkit designed for facilitating growth, we focus on enterprises with annual recurring revenue (ARR) between 2 to 15 million euros, where our value addition is most impactful.

Similar to any other company, we operate within an ecosystem. We have positioned ourselves where our toolkit adds the most value in growing the company and preparing it for the next stage in the investor landscape. Below is an overview of the tech investor landscape, highlighting Viking Venture’s specific position within the value chain.

Viking Venture’s investment profile

So, what does our investment profile look like? Well, to start with, we define ourselves as active minority investors, which means we do not require a majority of the shares to invest in your company. We have experience working with founders and other investors with a minority stake. We own the same type of shares as anyone else. However, we need to get a large enough share to create a solid return for our investors. Typically, Viking Venture owns 40-60% of the shares after the first investment round.

Active minority owner

As we seek to be an active sparring partner throughout the investment until exit, you should expect us to be involved. For us to be a good partner, however, it is a requirement that you want to work with us. Moreover, that the existing owners and management team are open to collaborating closely. It entails board representation, active discussions with the CEO, CFO, and other management, mentoring, M&A support, and more.

In-house consulting projects

Our Operational Excellence Team helps you run projects on strategy, price & packaging, and churn, to name a few. These projects are extended to our portfolio companies at no cost and have consistently generated substantial value.

Join a network of SaaS companies

On top of that, imagine having access to 20 other companies in different stages of the growth journey to discuss with. Being part of the Viking Venture portfolio allows everyone in your company to participate in the best B2B software community in Europe, where you get access to more than 2000 brilliant heads filled with knowledge and experience.

Balance your risk

All our investments are carried out with a combination of primary and secondary investments. Primary investment is the amount of cash injected into the company and what will finance the growth for the next 3-5 years. Secondary investments refer to the shares acquired from existing shareholders. In many cases, the founders have built their companies since inception and have held back on dividend payments and plowed all excess cash back into growing their business. Yet they still have a family to provide for, mortgages to serve, and re-payments on their car loans. In that case, it is not necessarily a good set-up if all their wealth ties up in a scale-up for the next five years. Hence, it is a good idea that the founders balance their risks and take some chips off the table by selling parts of their shareholdings.

Founder-friendly investor

In Viking Venture, we have a founder-friendly profile. We do not do preference structures and own the same type of shares as anyone else. As we enter a partnership to reach a common goal with the founders, we do not believe a set-up where the external investor has different incentives than the other shareholders is the right way forward. So, to reduce the risk of developing alternate motives and align our efforts, we want all shares to be treated equally.

We are always interested in talking with exciting B2B software companies. If our potential as partners resonates with you, we welcome your outreach. Connect with us, and we’ll arrange a productive discussion.

The investment process for SaaS Companies

Are you curious about how to navigate the investment process? Our next article offers a practical guide to what you can expect when discussing with potential investors. While specifics might vary among different investors, we’ll outline the investment process and highlight the essential considerations. We will take you through the key stages and crucial factors that deserve your attention as you navigate this transformative phase.