4 ways to reach your growth potential through M&A

Are you a Nordic B2B SaaS company looking to drive growth and stay ahead of the competition? In addition to organic growth through hunting and farming, mergers and acquisitions (M&A) is the third growth engine of your company and could be the key to unlocking new opportunities and achieving your business goals.

Written by: Eirik Hjelmeland, Investment Manager at Viking Venture

Why engage in M&A?

While most companies are familiar with growth through hunting and farming, M&A is often the least developed growth engine in a B2B SaaS company. There could be several reasons for this. Either the company has focused on achieving product-market fit and building the organization or lacks M&A competence, to name a few.

In our view, a company should exploit all growth engines, not just the organic ones. But growth is one of several reasons for companies to do M&A. This article will touch upon the most common rationales for acquiring or merging with another company.

M&A rationale

We divide the M&A rationale for B2B SaaS companies into four main categories:

- Consolidation

- Market entry

- Product expansion

- Competence/KPI improvement (or a combination of the above)

We will go through each category in the following sections.

Consolidating the market

A common rationale for doing M&A is consolidating the market, which means acquiring a direct competitor to gain a larger market share. Consolidation can result in several advantages for your company.

First, you have more market power, meaning that you can increase your prices. Second, you improve your economies of scale, which can drive your profitability. Third, you can get rid of a troublesome competitor, allowing you to spend more time (and money) on more value creating initiatives.

Market entry and geographical expansion

A key growth route for any company is to expand into new geographies. You can enter a new market in one of two ways, either organic or inorganic.

The former involves entering the market with your existing or new hired sales staff and growing through organic customer acquisition. The latter involves entering the market by acquiring a local target firm operating within the same space as yourself. We see several advantages with the latter approach.

Firstly, it is significantly less time consuming than organic entry as you by acquiring and target companies with an existing customer base you otherwise would spend several years obtaining through the organic approach. Secondly, your you acquire local sales staff, local know-how, and a well-functioning organization already operating in the market you want to enter.

Product expansion

Expanding your product portfolio is essential to increase growth from both new and existing customers. Product expansion could also be crucial from a retention perspective to stay on par or in front of your competitors. You can expand your products organically (i.e., with your own development resources) or through m&a deals.

The advantage with the latter is once again pace. You can spend less time developing and piloting new functionality and more time on new sale, up sale, and cross-sale, thus growing your business faster.

Acquiring for competence and KPI improvements

The last main rationale for doing M&A is to acquire competence your company is missing today and/or to improve your KPIs. An example could be to buy a competitor, not because they have a new product or are in a specific geography, but because they have a highly efficient and well-functioning new sales organization which will increase your company’s organic growth.

Competence and track record within cross-selling and customer success is other examples. Acquiring a highly profitable company to boost your combined EBITDA could be a third example.

Disadvantages of M&A

As stated above, M&A can result in several advantages to your company. However, it is important to remember that there are several potential risks as well. Common pitfalls are lack of cultural fit and time-consuming processes drawing focus away from your day-to-day operations.

Failure in the post-merger integration (PMI) process by underestimating the complexity is another risk. We will touch more on this in a later article.

Organic growth vs inorganic growth

It is also important to remember that organic growth is still valued more than inorganic growth (see our article about which SaaS KPIs that drive value in our valuation method here). Still, the more growth engines your company masters the better. This creates a more robust company with higher consistent growth over time.

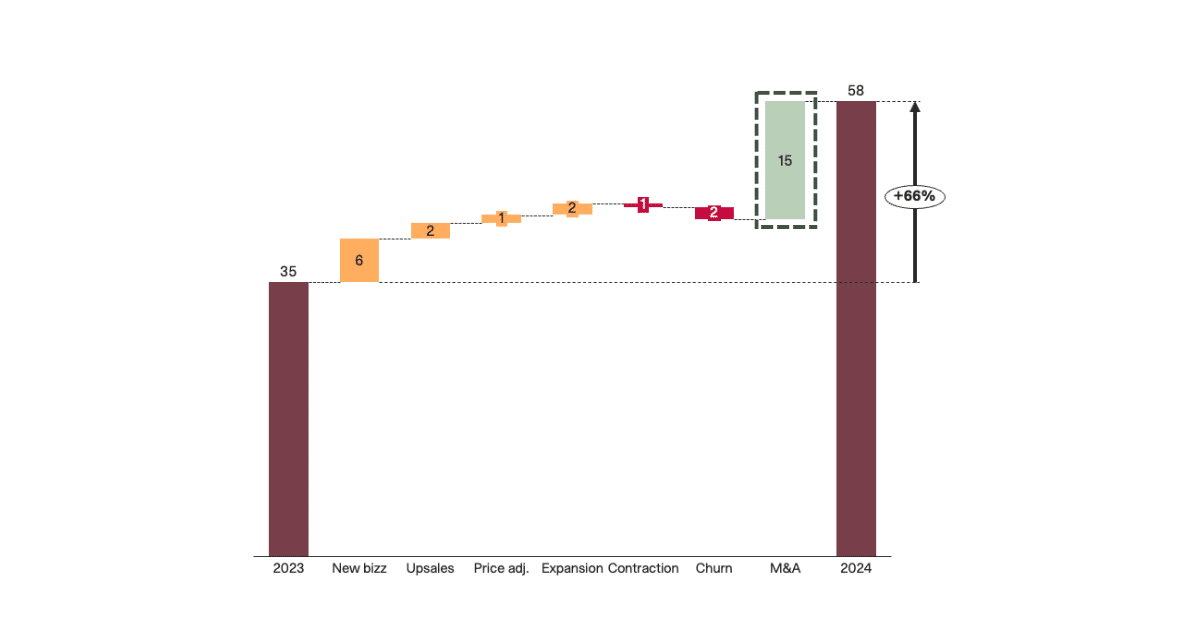

The average Viking Venture portfolio company grows 42% per year, and about 50% is growth through M&A transactions. Since 2020, our portfolio has completed more than 50 add-on acquisitions.

Acquisition process

Most of our companies have yet to make any acquisitions at the point we invest. However, we have a straightforward approach for knowledge transfer. For the first acquisition, Viking Venture runs and completes the process with the company assisting us.

The company drives the process in the second acquisition, supported by Viking Venture. For all subsequent add-on acquisitions, the company should be able to drive the process and complete the transaction themselves.

Unlock your growth potential through M&A

In conclusion, M&A can be a powerful growth engine for B2B SaaS companies, providing opportunities for consolidation, market entry, product expansion, and competence/KPI improvement. While potential risks are prevalent, our experience is that the benefits of exploiting both organic and inorganic growth engines outweighs the risks.

At Viking Venture, acquiring the right company at the right time is crucial for success, and our knowledge, experience and support can help you in your M&A journey. Doing mergers and acquisitions is always challenging, and picking the right financing, and deal structure has been especially challenging now. You can read more about our perspectives on our portfolio’s common financing sources, deal structures and our learnings from using earn-out mechanisms here.

You can also take the first step and reach out to us today to learn how we can help you unlock your growth potential through M&A.

What to prepare for when acquiring a company

Learn all aspects of the due diligence process of a Business-To-Business (B2B) SaaS company and what you should prepare for when either being acquired or acquiring a company.

Ørn Software’s acquisition strategy for ARR growth

Ørn Software has grown its annual recurring revenue (ARR) 11.5 times, from NOK 21 million to 244 million in the last 4.5 years. Sten-Roger Karlsen, CEO of Ørn Software, shares how they have succeeded with their growth strategy. In this interview, he sheds light on how to win your acquisition candidates.