4 SaaS KPIs to improve your growth and profitability

Key performance indicators (KPIs) help you focus on what matters the most. This article reviews four essential SaaS KPIs for measuring growth and profitability. We look at total annual recurring revenue (ARR), organic ARR growth rate, churn, and the Rule of 40. We want to help you understand why these KPIs matter, how we measure them, and how to become a top performer of each KPI.

Written by: Ingvild Farstad, Community Manager at Viking Venture

1. Improve your total ARR growth

Annual Recurring Revenue is the holy grail of a software-as-a-Service (SaaS) company, and there is a strong correlation between ARR growth and valuation. To better understand why total ARR is an essential KPI, and how we work to improve ARR growth, it is helpful to take a quick look at our investment process and how we drive growth together with the company after signing.

In short, when considering a new investment, we use our Viking Venture KPI Dashboard to assess the company’s KPIs and gauge whether there is an opportunity for us to leverage our toolkit to drive growth. By doing this, we connect valuation and value development. At investments, we are always setting significant milestones for the next 3-5 years together with the company. These milestones form a value creation plan with initiatives to improve growth.

Typically, this value creation plan include initiatives like:

- Increasing the prices

- Professionalizing and strengthening sales and marketing

- Completing successful add-on acquisitions

These are all key drivers for growth and part of the Viking Venture toolkit. We work together with our portfolio companies to achieve sustainable and predictable ARR growth over time. Our Operational Excellence team, together with our companies, run projects based on the value creation plan and goal for ARR growth.

What is total ARR growth and how to measure it?

ARR is typically driven by the software as a service (SaaS) business model. Growth in ARR is measured by dividing the total change in ARR within a certain period by the ARR balance at the start of a said period. In other words, the sum of what you gain in new sales, upsells, price increases, expansion, and acquisitions minus contraction and churn within a specific period. We like to illustrate the development in ARR with a waterfall graph, as seen below. At Viking Venture, we measure this monthly and typically look at the last twelve months to see the development of ARR growth.

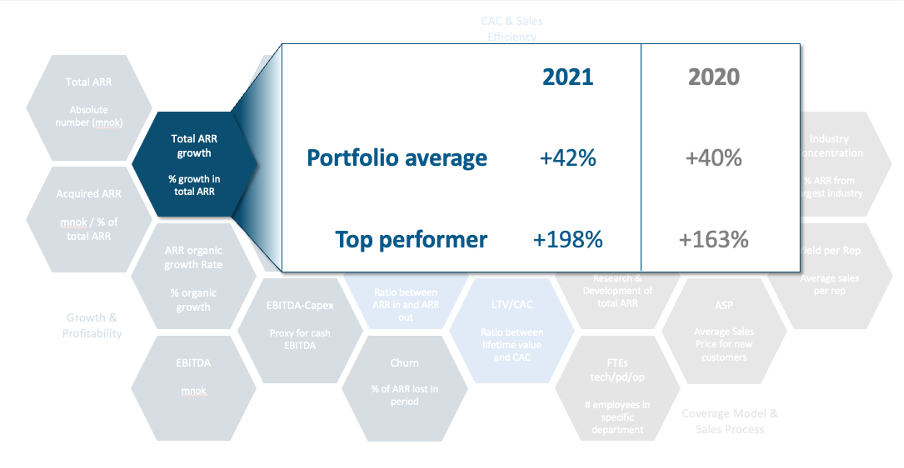

Benchmark for total ARR growth:

2. Focus your attention on organic growth

The ARR organic growth rate excludes the effects of acquisitions. If we look at total ARR growth in our portfolio, there is a 50/50 split between organic and inorganic growth. Both are essential levers for a higher valuation, but not having organic growth will have negative effect on a company’s valuation. That is why we must distinguish between organic and inorganic growth to understand the underlying drivers and where we need to improve. In an ideal world, organic growth comes from a mix of new customers, expansion and upsell to existing customers and regular price increases throughout the customer life cycle.

Benchmark for organic ARR growth:

3. Understand the causes for churn

Churn measures the revenue or customers lost in a certain period. Increasing churn rates indicate unhappy customers, and churn is in direct opposition to growth and must be measured and tracked. A company with high churn rates will constantly play catch-up when trying to grow.

Knowing your churn is vital for forecasting, but the real value lies in understanding why customers choose to cancel their subscriptions. We have run several projects with our portfolio companies to understand the root causes of churn and have identified key steps to fighting churn.

These are essential steps when understanding churn:

- Measure churn both in terms of ARR and # of customers

- Find the root cause of churn

- Define your ideal customer

- Segment your customers

- Use data to narrow your efforts

- Onboard for success

- Align incentives across departments

Benchmark for churn:

4. Find the right balance between growth and profitability

To achieve sustainable and predictable growth, you must understand the underlying drivers. This will give you a better idea of your options when investing and help you decide when to hit the accelerator and when to grab on to the brakes.

All businesses need to understand the balance between growth and profitability to ensure they have a risk-adjusted growth profile. The focus of all B2B SaaS companies should be on increasing ARR. Therefore, we use organic ARR growth rate rather than revenue when calculating the Rule of 40. The EBITDA margin is widely accepted as a measure of profitability. For a company to achieve a healthy Rule of 40 score, the sum of growth and profitability must be 40 % or higher. When you accomplish this, we can conclude that there is a healthy balance between growth and profitability.

What do the top performers do differently?

Insight and knowledge into how your company is performing is key to continue growing and optimizing your software business in a healthy way. Tracking the right SaaS KPIs tells you what is working well and what needs to be improved. The best performing companies have found good ways of working through data-driven decisions. Thus, we have collected the top SaaS KPIs you need to track in 2023 in one article with benchmarks from our portfolio companies.

As Lord Kelvin says: “If you cannot measure it, you cannot improve it.”

Is there an increased focus on profitability?

With the recent shifts in the market, could profitability be more important than growth for software companies? Learn more on how profitability impact valuation, and is the Rule of 40 becoming an outdated SaaS KPI?

Get more insights on how to scale your business

Sign up for our newsletter to get valuable insights and the latest perspectives on how Nordic software companies can scale faster. Learn how to improve sales processes, develop your management team, optimize pricing and accelerate through acquisitions.